Finance

How Economic Cycles Influence the Availability and Cost of Lines of Credit

Key Takeaways

- Economic cycles significantly impact lenders’ willingness and ability to extend credit lines to consumers and businesses.

- Credit is generally easier to obtain during economic expansions, while contractions tend to result in stricter lending criteria and reduced access to credit.

- Interest rates fluctuate alongside economic cycles, affecting the overall cost of borrowing.

- Strategic financial management and diversification can help businesses weather changes in credit availability.

- Government intervention can play a vital role during downturns by supporting access to credit.

Understanding Economic Cycles and Their Phases

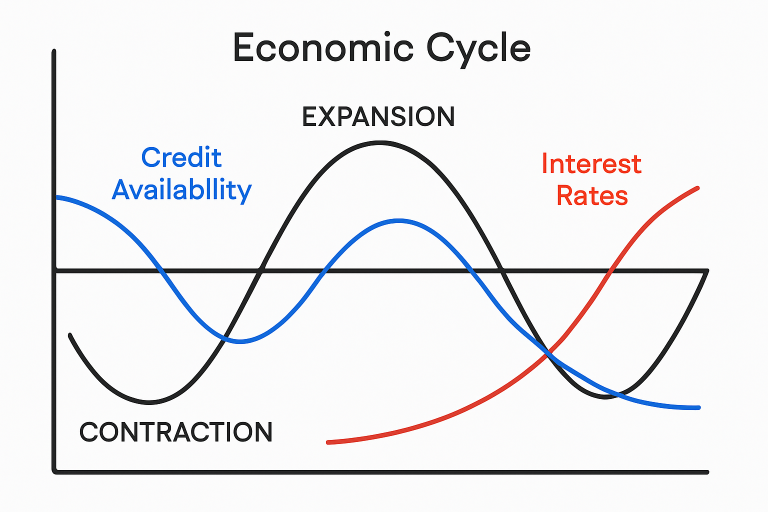

Economic cycles, which alternate between periods of growth and recession, have far-reaching effects on financial systems worldwide. As economies enter an expansion phase, job creation accelerates, consumer confidence typically rises, and businesses and households are more likely to seek financing. Lenders, in turn, react to these positive conditions by offering more flexible terms and increased lending volumes to meet rising demand.

During periods of contraction or recession, however, a slowdown in economic activity and rising unemployment can dampen consumer and business confidence. This shifts how lenders evaluate and approve credit, often making access to funding more restrictive. Working with invoice finance companies becomes a valuable option for businesses managing cash flow during these periods, helping them unlock capital tied up in unpaid invoices and maintain liquidity without relying solely on traditional bank lending.

The Relationship Between Economic Cycles and Credit Availability

Lenders continuously adjust their risk appetite in response to economic cycles. During boom periods, banks and alternative lenders relax lending standards amid greater confidence in borrowers’ repayment. Venture capital and other private sector finance sources also become more accessible, broadening credit options for companies looking to invest or expand.

On the other hand, when economic indicators turn negative, institutions typically adopt a more conservative approach. This change can trigger a “credit crunch,” where the pool of available credit contracts shrinks even as demand for liquidity increases. The effects can be especially pronounced for smaller businesses or those in higher-risk sectors, as banks tighten eligibility requirements and increase scrutiny.

Impact on Interest Rates and Borrowing Costs

The prevailing economic environment heavily influences the cost of accessing lines of credit. Central banks, such as the Federal Reserve or the Reserve Bank of Australia, use monetary policy tools to affect the benchmark interest rates, setting the tone for the entire lending market. During downturns, rate cuts encourage borrowing and stimulate investment, lowering costs for businesses and consumers. Loan products, including revolving lines of credit, often see corresponding decreases in their variable interest rates.

Conversely, central banks may increase rates to contain inflationary pressures during periods of rapid economic growth, raising the cost of borrowed funds. This directly impacts business operational expenses and can influence strategic decision-making across sectors. The interplay between rates and lending standards can be observed globally and notably affects consumer debt and business investment decisions.

Strategies for Businesses to Navigate Credit Fluctuations

Maintain Financial Strength

A business’s first line of defense against tighter credit conditions is ensuring a solid balance sheet. Regular financial reviews, diligent management of receivables and payables, and keeping healthy cash reserves increase a company’s attractiveness to lenders in lean times.

Diversify Lender Relationships

Relying on a single lender creates risk, especially if that lender substantially tightens terms or withdraws credit lines during a downturn. Establishing relationships with multiple financial institutions, alternative lenders, and specialty finance firms provides flexibility when access to traditional funding is restricted.

Secure Credit in Advance

Proactive businesses often lock in lines of credit or refinancing arrangements during boom cycles when lending standards are more relaxed. These facilities can act as financial cushions if the economic environment worsens and traditional lenders become less cooperative.

The Role of Government Policies and Interventions

Government programs are vital during economic stress for sustaining access to credit, especially for small and mid-sized enterprises, which may struggle the most during credit crunches. Policy measures may include direct lending, loan guarantees, or programs that increase banks’ reserve capacity, enabling them to continue lending even as markets contract.

Initiatives like the State Small Business Credit Initiative (SSBCI) in the United States are designed to stimulate economic activity by making credit more available. National banks and government agencies worldwide frequently intervene with similar measures, underscoring the importance of public-private coordination in stabilizing credit markets during downturns.

Final Thoughts

The ebb and flow of economic cycles profoundly shape the landscape for lines of credit, affecting both their accessibility and cost. Understanding how lenders respond to changing macroeconomic signals empowers businesses to take proactive steps—such as maintaining robust financials and diversifying banking relationships—to protect themselves from the negative effects of tightened lending. Coupled with informed government intervention, these efforts can help mitigate the adverse impacts of economic downturns, ensuring continued access to much-needed financial resources.