Finance

Strategic Wealth Management for Ultra-High-Net-Worth Individuals: Meeting Diverse Family Needs

Table of Contents

- Introduction

- Understanding the Complexities of UHNWI Wealth Management

- Integrated Family Wealth Management: A Holistic Approach

- Customized Investment Strategies

- Succession Planning and Legacy Preservation

- Philanthropy and Social Responsibility

- Leveraging Family Offices for Comprehensive Management

- Conclusion

Introduction

Ultra-high-net-worth individuals (UHNWIs) encounter a range of unique challenges when managing their wealth, particularly as their financial strategies must accommodate the varied objectives of family members across generations. These families often require an elevated level of coordination to balance growth, stability, risk management, and interpersonal priorities. Other Scottsdale wealth managers, such as Caprock, focus on to UHNW investors. Wealth management involves much more than optimizing investment portfolios—it is a dynamic process that connects financial solutions to personal values and legacy.

Sophisticated wealth management requires a personalized approach that integrates investment planning, tax optimization, estate structuring, and philanthropic endeavors. Every family’s circumstances diverge, which means strategies must adapt to the complexity of modern family dynamics, changing regulations, and new opportunities for multigenerational impact. Advisors must be vigilant, forward-thinking, and holistic in their methods.

Understanding the Complexities of UHNWI Wealth Management

The stewardship of substantial wealth is inherently multifaceted. Beyond investments, UHNWIs must address unique estate planning considerations, international tax liabilities, and ever-evolving regulatory landscapes. Family members may have different risk profiles, career interests, or expertise, making financial literacy and communication essential for harmony and shared direction.

Wealth managers must deploy a comprehensive approach that blends legal, financial, and interpersonal guidance. As family governance grows in importance, so does the need for clear problem-solving frameworks to preempt potential conflict. Engagement, education, and open discussion ensure that all generations can contribute to a legacy that reflects both individual aspirations and collective values.

Integrated Family Wealth Management: A Holistic Approach

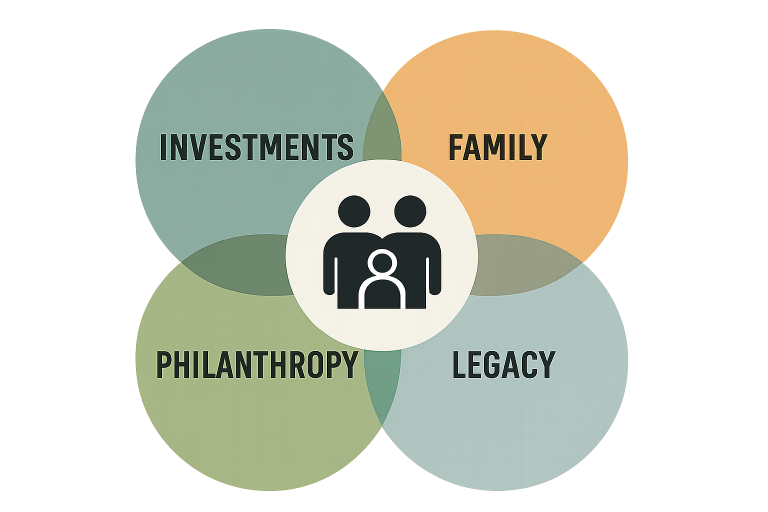

Integrated Family Wealth Management (IFWM) emphasizes aligning financial strategy with long-term family goals and fostering cohesive decision-making. This holistic approach not only coordinates investments and liquidity needs but also weaves in family governance, tax and estate planning, and strategic philanthropy. By incorporating strategies for building generational wealth as outlined by U.S. News, families can ensure their financial planning supports long-term legacy goals. The process merges technical expertise with a deep understanding of the family’s culture, mission, and global interests. By taking an IFWM approach, UHNWIs can address financial uncertainty while prioritizing values such as stewardship, innovation, and entrepreneurial vision.

Customized Investment Strategies

Investment strategies for UHNWIs must be meticulously tailored to accommodate the multitude of variables unique to each family—risk appetite, investment timeframes, ambitions, and interests. By diversifying across public equities, private equity, real estate, and alternative assets, families can seek growth opportunities, hedge against macroeconomic shifts, and better insulate their portfolios from volatility.

Strategic asset allocation, proactive risk management, and periodic rebalancing are imperative. Managers may leverage private market opportunities and direct investments to capture higher returns, while also integrating environmental, social, and governance (ESG) criteria to align investments with family values. For additional insights into bespoke investment frameworks for UHNWIs, visit resources like Kiplinger.

Working closely with specialists in taxation, legal matters, and philanthropy ensures that investment plans are holistic and robust. Implementing clear family governance structures promotes transparency and keeps all generations aligned. By adopting a flexible and actively managed approach, UHNWIs can safeguard wealth while achieving long-term strategic objectives.

Succession Planning and Legacy Preservation

The preservation and growth of family wealth relies on clear succession planning and the cultivation of responsible next-generation stewards. Constructing transparent governance structures—often through trusts, family constitutions, or holding companies—helps clarify decision-making and aligns family members behind unified goals.

Proactive education is vital. UHNW families are increasingly prioritizing financial literacy programs for heirs, creating family councils, and fostering open dialogue to ensure the smooth transfer of assets and maintain family harmony. Forward-looking succession strategies fortify families against disruption and empower future leaders with clarity and confidence.

Philanthropy and Social Responsibility

Philanthropy is a cornerstone of many UHNWI family endeavors, woven deeply into legacy planning and social responsibility. Strategic giving programs—be it through family foundations, donor-advised funds, or direct initiatives—can align tax benefits with transformative impact, instilling shared purpose across generations.

Effective philanthropic planning starts with a genuine understanding of family values and priorities, then building frameworks for engagement, accountability, and impact measurement. These initiatives often extend the family’s influence beyond business and investment, creating a legacy of positive social and environmental change.

Leveraging Family Offices for Comprehensive Management

Family offices have evolved as the ultimate wealth management structure for UHNWIs, offering a purpose-built, centralized solution for managing diversified investments, legal and tax structures, and family governance. Whether operating as single-family or multi-family offices, they provide personalized, integrated services that support every aspect of complex wealth management—from private banking and concierge services to risk management and legacy planning. As the needs of wealthy families grow more sophisticated, having a forward-thinking, adaptable family office is increasingly essential.

Conclusion

Ultra-high-net-worth individuals must approach wealth management with a comprehensive, personalized strategy—one that balances wealth preservation and growth with their families’ evolving needs. By embracing holistic planning, fostering family education and transparent decision making, and leveraging the right structures and experts, UHNW families can steward their legacies while empowering future generations for lasting prosperity and influence.