Health and Wellness

Medicare Enrollment Process: A Comprehensive Guide

Key Takeaways

- Understanding and acting during the correct Medicare enrollment periods is crucial for avoiding penalties and ensuring continuous coverage.

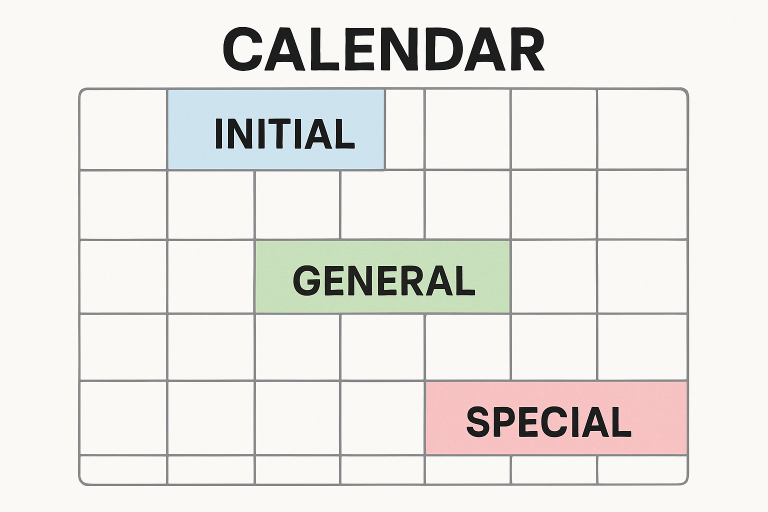

- There are different enrollment periods, including Initial Enrollment Periods, General Enrollment Periods, and Special Enrollment Periods—each catering to specific situations.

- Stay informed about recent rule changes and annual plan updates to optimize your Medicare coverage.

- Utilize free resources for guidance and review your options every year to match your healthcare needs.

Understanding Medicare Enrollment Periods

Navigating the Medicare enrollment process can feel overwhelming, but understanding the critical timing can make it much easier. The Initial Enrollment Period (IEP) is your first opportunity to sign up, lasting seven months—from three months before the month you turn 65, including your birthday month, and three months after. Enrolling on time ensures you avoid unnecessary penalties and enjoy uninterrupted coverage right when you need it. Many people miss out simply because they are unaware of the correct enrollment windows, which is one of the most common Medicare mistakes new beneficiaries make.

Missing the IEP can result in late enrollment penalties, as well as delays in your coverage start date. That’s why setting reminders and planning early can save you money and reduce stress later on. It’s also essential to understand the available options, especially if you’re still working at 65 or receiving employer-provided insurance at the transition point.

General Enrollment Period: A Second Chance

If you miss the Initial Enrollment Period, the General Enrollment Period (GEP) gives you another opportunity. Running annually from January 1 to March 31, GEP lets you sign up for Medicare Part A and/or Part B if you didn’t enroll when you were first eligible. Coverage now begins the month after enrollment, a recent update that helps minimize gaps. However, enrolling through GEP often results in permanent late penalties being attached to your monthly premium, so using this period should be a backup strategy rather than the primary plan.

Special Enrollment Periods for Qualifying Events

Life is unpredictable—fortunately, Special Enrollment Periods (SEPs) exist for those facing significant changes. You might become eligible for an SEP if you lose employer health coverage, move out of your plan’s service area, or face certain other life events. SEPs are designed to maintain continuous coverage and avoid penalties, making them an essential safety net for unexpected circumstances. Understanding SEPs is especially vital for those retiring past 65 or whose coverage arrangements are changing mid-year.

Medicare Advantage Open Enrollment Period

From January 1 to March 31, the Medicare Advantage Open Enrollment Period provides participants with an additional layer of flexibility. If you joined a Medicare Advantage plan but quickly realize it isn’t meeting your needs, this period allows one change: you can switch to another Medicare Advantage plan or go back to Original Medicare, possibly adding Part D drug coverage. This option helps ensure you are not locked into a plan that doesn’t work for your unique circumstances for the entire year.

Key Changes in Medicare Enrollment Rules

Major policy updates have made Medicare more accessible and user-friendly. For example, coverage now begins the month following your GEP or SEP enrollment, rather than several months later, as in the past. This update, among others, helps reduce coverage gaps and reflects growing efforts to make healthcare access more equitable. New SEPs, recognizing exceptional circumstances such as natural disasters or loss of Medicaid coverage, are also part of these reforms. These changes put more control in the hands of beneficiaries, especially those facing life’s unpredictable turns.

Steps to Enroll in Medicare

- Determine Your Eligibility: Most people qualify at age 65, but some younger individuals with certain disabilities or conditions may also be eligible.

- Choose Your Coverage: Consider whether Original Medicare (Parts A and B), a Medicare Advantage plan (Part C), or additional options like Part D for prescriptions or Medigap for supplemental coverage best fits your needs.

- Enroll: Sign up online through the Social Security Administration, by phone, or visit your local SSA office. Gather all needed documents ahead of time to simplify the process.

- Review Annually: Each year, from October 15 to December 7, review your health and drug plans during the annual Open Enrollment period. This is the best time to make changes if your needs or plan options have shifted.

Common Mistakes to Avoid

- Missing Enrollment Deadlines: Failing to enroll during your IEP or other qualifying periods can result in additional costs and prolonged delays.

- Overlooking Plan Changes: Medicare plans change each year. Failing to review your Annual Notice of Change or compare plans could result in inadequate or more expensive coverage.

- Ignoring Prescription Coverage: Even if you do not currently take medications, skipping Part D at first eligibility can leave you facing significant penalties if you later need coverage.

Final Thoughts

Successfully navigating Medicare enrollment requires careful planning, attention to deadlines, and a thorough understanding of the various enrollment periods. Taking proactive steps—such as reviewing coverage annually, considering Special Enrollment Periods, and avoiding common mistakes—can help you save money and ensure uninterrupted access to healthcare. Staying informed about changes in Medicare rules and utilizing available resources empowers you to make choices that best fit your health needs. By approaching enrollment thoughtfully, you can confidently secure the coverage and benefits you deserve.